Yesterday, my Esteemed Co-Blogger Rogier posted with some concern about a recent IMF forecast that the United States will soon no longer be the world’s largest economy. According to a Brett Arends at MarketWatch, this will be a disaster:

According to the latest IMF official forecasts, China’s economy will surpass that of America in real terms in 2016 — just five years from now.

Put that in your calendar.

It provides a painful context for the budget wrangling taking place in Washington right now. It raises enormous questions about what the international security system is going to look like in just a handful of years. And it casts a deepening cloud over both the U.S. dollar and the giant Treasury market, which have been propped up for decades by their privileged status as the liabilities of the world’s hegemonic power.

I don’t know much about the Treasury market, and I know even less about the currency markets, so I’m willing to believe that a change in the U.S. economy’s world ranking could spell disaster for either of those, but I’m not sure why the rest of us should care. In fact, I think we can be cautiously optimistic.

For one thing, the major nations of the world don’t compete against each other the same way that companies do. One key reason is that the majority of goods and services produced by a country are consumed by that country. If nearly all Coca-Cola was consumed by Coca-Cola employees, and nearly all Pepsi was consumed by Pepsi employees, they would not be competing against each other, and a change in the size of the Coca-Cola market would not affect the welfare of Pepsi employees very much. For similar reasons, a change in Chinese GDP doesn’t have a huge negative effect on the welfare of American citizens.

Also, when it comes to individual well-being, GDP figures are not a good indicator because GDP is not adjusted for population size. We can make a better comparison by switching to per-capita figures. For example, in 2010, U.S. GDP was $14.6 trillion, and Chinese GDP was $9.4 trillion. However, the 2010 populations of the U.S. and China were 309 million and 1,350 million, respectively, meaning that China had about 2/3 the GDP despite having a population almost 4 times larger.

The upshot is the Chinese economy provides the average Chinese resident approximately$7000 per year in consumable goods and services, whereas the U.S. economy provides each person with an average of $47,000 worth of consumable goods and services.

That’s a ratio of about 6.8 to 1, which means it will take China a lot longer to raise individual well-being to U.S. levels that it would take to simply match our aggregate GDP with their much larger population. And again, the U.S. and China are not in direct economic competition, so the increase in Chinese welfare does not come at our expense.

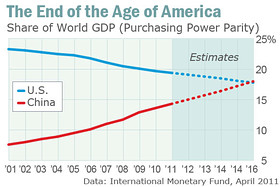

Finally, Arends’ article includes this interesting graph:

Note that this displays the sizes of the U.S. and Chinese economies as a percentage of the world economy. This means that if the economies of other countries are improving, the U.S. share of the world economy could go down, even if GDP rises in the U.S.

Instead, let’s look at absolute Purchasing Power Parity GDP:

In this chart, you can see that for most of the last three decades, U.S. GDP has been rising pretty steadily, with only a few hiccups, at least until the start of our current recession (which is, as this chart makes clear, shockingly larger than any other recession in the last 30 years).

However, the current recession only explains part of China’s gain on the U.S. economy. The other half of the story is visible in the Chinese GDP data which after 2000 begins rising much more rapidly than before. So while some of China’s gain is due to our recent economic problems, an awful lot of the gain is due to improvements in the Chinese economy.

There are three reasons not to worry about this sudden Chinese growth spurt. First, this period of rapid growth is happening because, after decades of inefficiency under a command economy, Chinese rulers have finally permitted some market reforms, and Chinese businesses are modernizing. Basically, China’s economy is growing quickly because it is finally starting to catch up to the modern world. And in economics, catching up is always faster, because equipment and factories can be upgraded directly to the latest technology, rather than having to evolve it the way the economic leaders did.

Second, there’s reason to believe that economic growth brings freedom. As more and more people become wealthier and wealthier, they begin to use that wealth to exert control over their own lives. Free countries are less likely to get into wars with each other.

Third, once China’s economy catches up to the economic leaders, its growth will have to slow down because it will no longer be adopting off-the-shelf technology. China will be restrained by the rate of invention of new technology like everybody else, which will spur enterprising Chinese firms to invest heavily in improving technology. Those technological advances will become available to other countries as well, raising the standard of living everywhere. Basically, the more people who are inventing new technology (instead of just playing catch-up), the better we all are.

Having written all these optimistic observations, I have to point out that China’s leaders might very well use some of their new wealth to fund militaristic adventures and, as we in the U.S. are learning, even wealthy countries can lose ground on freedom.

(Since the MarketWatch article used the Purchasing Power Parity GDP, so did I, pulling data from the Wolfram Alpha knowledge engine. Population figures are the latest figures from the CIA World Fact Book.)

Thank you for pointing this out. It always gets me when I see these doom and gloom numbers. They seem to think that economics is some sort of zero sum game. That somehow the rise of hundreds of millions of people out of poverty is a bad thing for us.

Hold on, fellas. I didn’t say that China’s economic ascendance is a “threat,” much less a “disaster.” And I certainly have no objections to hundreds of millions of Chinese rising out of poverty. On the contrary. Maybe you should check out a post of mine from a few years ago, especially this part:

http://www.bakelblog.com/nobodys_business/2008/08/the-faux-humani.html

So why am I chagrined about seeing America’s #1 spot taken by the Chinese? For one thing, because economic size translates into real-world influence and real-world power. I’m loath to see the United States take a backseat to China, especially since our financial indebtedness to China is growing. After all, being (literally) indebted means we’ll have to be polite and pliant to a dictatorial communist regime that is infamous for crackdowns on personal freedom.

I hope Mark is right about growing per-capita wealth leading to growing personal liberty, and I’ve argued the same point in the past, but right now the opposite seems to be happening. The Chinese government’s recent actions against Ai Weiwei, and other artists and dissidents, may point to a new confidence that Beijing bureaucrats can do what they want without fear of international repercussion, perhaps because they have all of us eating out of their renminbi-filled hands. The regime’s harassment and arrests of the Shouwang Church members is more evidence for that theory.

I mostly riffed on the topic, yesterday, because it seemed funny & sad to me (as I said) that while we’ve recently lost gobs of prestige, power, influence, and bragging rights to a country that 20 years almost no one took seriously as a number-one contender, we’ve been embroiled in insane debates over presidential blowjobs and guys kissing. I would have preferred that, as a nation, we’d focused on building a much more robust economy that produced both more liberty and more individual wealth.

Consider this:

http://reason.com/blog/2011/04/25/americas-lost-decade-now-in-it

We could have done scores better, no?

I realize my post from yesterday was a bit cryptic, and I should have been clearer. My mistake. Your mistake, perhaps, was jumping to conclusions about what I meant?

Actually my comment was not directed at you specifically Rogier. I have read your work enough over the last couple years to know that wasn’t the case. It was more directed at the mainstream media types who regularly react this way.

See examples I just pulled immediately such as:

http://www.voanews.com/english/news/usa/Is-the-US-Losing-the-Innovation-Race-Against-China-and-India-116428764.html and of course from our coming presidential candidates http://politics.blogs.foxnews.com/2011/04/26/romney-cain-sound-alarm-over-report-chinas-economy-will-surpass-us.

I definitely see your point however. This last recession has set us back years and long term debt combined with crippling regulation are trying to strangle us.

I was responding more to the original MarketWatch piece than to your post. I get peeved by financial market analysts who think everything that’s bad for them is bad for the U.S. economy. Another point I could have made, however, is that the fact that “we’ve been embroiled in insane debates over presidential blowjobs and guys kissing” instead of “building a much more robust economy that produced both more liberty and more individual wealth” is a bad thing in and of itself, regardless of what China is doing.